In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the EURUSD for 31st May 2024.

Key Takeaways

- Good news for expected interest rate cuts: The revised annualized quarterly real GDP rate in the first quarter of the United States has been lowered to 1.3%, a new low since the first quarter of 2023. Consumer spending and inflation have both declined. The monthly rate of completed home contract sales in the United States in April came in with -7.7%, a new low since February 2021.

- Importance of core PCE annual rate: Today, the United States will release the April core PCE price index. Federal Reserve’s Williams said yesterday that inflation remains too high and the performance since the beginning of the year has been disappointing. The key lies in whether there are any signs of price decline in the first month of the second quarter. If it remains high or even exceeds expectations, there is still hope for a strong US dollar index.

Technical Analysis

Daily Chart Insights

- Stochastic Oscillator: After leaving the overbought area, the indicator has once again issued a bearish signal. Yesterday, the fast line indicator fell below the median line, indicating a downward trend ahead. If the slow line also falls and breaks through the median line, attention can be paid to opportunities for bearish positions.

- Oscillating range: The moving average group begins to entangle horizontally, and multiple moving average supports prevent the pair from falling further. Above the pair, there is a downward trend line. If the current pair wants to form a trend direction, it needs to break through the corresponding resistance area.

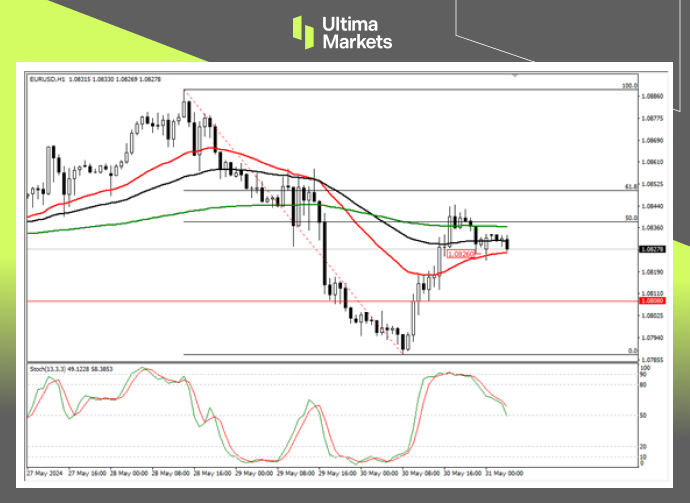

Hourly Chart Analysis

- Stochastic Oscillator: The indicator issued a bearish signal in the oversold area yesterday. 1.08260 is the lowest price at the time of the signal formation, and if the pair closes below this level, it is worth paying attention to short-term selling opportunities.

- Long-short conversion area: From a time cycle perspective, there is a high probability of a decline in the euro against the US dollar today. It is worth noting that 1.08080 is a recent short-conversion region and the pair needs to fall below this level in order to aggressively believe that the euro will continue to depreciate. Conversely, there is still a possibility of an upward trend in the pair.

Pivot Indicator

- According to the trading central in Ultima Markets APP, the central price of the day is established at 1.0805,

- Bullish Scenario: Bullish sentiment prevails above 1.0805, first target 1.0850, second target 1.0865;

- Bearish Outlook: In a bearish scenario below 1.0805, first target 1.0785, second target 1.0770.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server